Folks talking about software-as-a-service (SaaS) and cloud computing often use the label "hybrid." I understand that "hybrid" refers to something that's part "this" and part "that."

I'm just not always sure what "this" and "that" are.

Sometimes "hybrid" refers to a solution that runs partly in the cloud and partly on-premise. An email system, for example, might handle some functions on a remote server accessed via the web, but other functions might be managed on the user's desktop. Anti-virus applications often work this way as well.

Other times, "hybrid" refers to a solution that is hosted and managed by the provider, but can be extensively customized by the user. This is in contrast to the more pure, multi-tenant SaaS model in which solutions can be configured, but not customized.

In a third option, "hybrid" is used to refer to a solution that can run either on a "public cloud" or on a company's internal "private cloud," or dispersed across the two.

And in yet another variation, vendors who offer their customers a choice of SaaS, on-premise, or hosted options are described as following a "hybrid" business model.

I won't get into the wisdom of any of these options right here, except to note that each of them comes with its own set of challenges. (Elsewhere, I have addressed whether companies can offer both on-premise and SaaS options.) And as Joel York astutely points out, vendors should make a conscious and deliberate choice among these options, rather than wandering carelessly into the middle of the road.

"This is this."

My point here for marketers is this: Be careful with words.

This emerging market is already confusing enough, with terms like "SaaS,""platform-as-a-service (PaaS)," "cloud," etc. (See "War of the Words.) That confusion will delay the sales cycle or even cost you business.

Marketers should educate CEOs, CIOs, procurement professionals, end users and anyone else in the evaluation process on what these terms mean. Just because you've immersed yourself in the nuanced vocabulary of this market (and read blogs like this one), doesn't mean your buyers have done the same.

If I'm sometimes confused what people mean when they talk about "hybrid" solutions, assume that your prospective customers could be confused as well.

By the way, this dialogue from "The Deer Hunter" offers some useful insight on the need for clarity:

Michael, played by Robert DeNiro, explains, "This is this. It ain't something else. This is this."

And his hunting companion Stanley, played by John Cazale, responds," 'This is this.' What the hell is that supposed to mean? 'This is this.'"

Monday, June 29, 2009

Tuesday, June 23, 2009

SaaS Renewals and the Multiplier Effect

In case you've forgotten the concept of the multiplier effect from Economics 101, it's commonly used to project the impact of a change in government spending or money supply on the growth of GDP.

If, for example, we know that the government spending multiplier is 5, and the government increases spending by $10 billion, we'd project that GDP would grow by $50 billion.

In a similar fashion, renewals have a multiplier impact on SaaS companies' revenues.

The higher the renewal multiplier - that is the more times a company can renew a customer and extend its revenue-generating life - the greater the revenue accruing to the company.

Lifetime Customer Revenue

To be more precise, what we're actually referring to here is "lifetime customer revenue."

Lifetime customer revenue = recurring revenue per period * term of customer lifetime

As an example, I'll calculate the average lifetime customer revenue for salesforce.com, estimating a 3-year customer life multiplier:

To illustrate the dramatic impact of longer customer life on lifetime revenue, I've calculated the lifetime customer revenue at several publicly-held SaaS companies, using 5-year, 3-year and 1-year renewal multipliers. As expected, a higher renewal multiplier yields substantially higher revenue.

The relationship between the renewal multiplier, lifetime customer revenue and customer acquisition cost

This calculation becomes truly useful when comparing the lifetime customer revenue to the cost of acquiring a customer, i.e. sales & marketing expenses.

According to this illustration, when salesforce.com can extend the average customer lifetime to 5 years, the company generates $2.40 in lifetime customer revenue for every $1 spent on customer acquisition. At a 3-year lifetime, $1.44 of lifetime revenue is generated. And at a 1-year customer lifetime, only 48 cents of revenue is generated for every $1 spent on sales & marketing.

Don't lose customers you've already paid for

As you can surmise, spending more than $1 to acquire a customer that yields less than $1 in lifetime revenue is not a sustainable business model.

Extending the life of the customer's subscription is critical to success. It's bad business to lose customers you've already paid for.

If, for example, we know that the government spending multiplier is 5, and the government increases spending by $10 billion, we'd project that GDP would grow by $50 billion.

In a similar fashion, renewals have a multiplier impact on SaaS companies' revenues.

Lifetime Customer Revenue

To be more precise, what we're actually referring to here is "lifetime customer revenue."

Lifetime customer revenue = recurring revenue per period * term of customer lifetime

As an example, I'll calculate the average lifetime customer revenue for salesforce.com, estimating a 3-year customer life multiplier:

$985 million in FY 2009 annual subscription revenue/55,400 customers = $17,780 average annual revenue per customer

$17,780 average annual revenue per customer * 3 year customer lifetime = $53,340 lifetime customer revenue.

Changing the renewal multiplier to a 5-year customer life, yields a more favorable result:$17,780 average annual revenue per customer * 3 year customer lifetime = $53,340 lifetime customer revenue.

$17,780 average annual revenue per customer * 5 year customer lifetime = $88,900 lifetime customer revenue.

The relationship between the renewal multiplier, lifetime customer revenue and customer acquisition cost

This calculation becomes truly useful when comparing the lifetime customer revenue to the cost of acquiring a customer, i.e. sales & marketing expenses.

Average lifetime customer revenue/average customer acquisition cost

This formula reveals how much lifetime customer revenue is generated by $1 in customer acquisition costs. (I discussed this concept at greater length in the May 2009 newsletter and in an earlier post entitled "Marketing Spend: How Much is Enough?")

According to this illustration, when salesforce.com can extend the average customer lifetime to 5 years, the company generates $2.40 in lifetime customer revenue for every $1 spent on customer acquisition. At a 3-year lifetime, $1.44 of lifetime revenue is generated. And at a 1-year customer lifetime, only 48 cents of revenue is generated for every $1 spent on sales & marketing.

Don't lose customers you've already paid for

As you can surmise, spending more than $1 to acquire a customer that yields less than $1 in lifetime revenue is not a sustainable business model.

Extending the life of the customer's subscription is critical to success. It's bad business to lose customers you've already paid for.

Friday, June 19, 2009

Measuring Renewals

Early in my career, I taught bank credit analysts-in-training how to read financial statements. During my course, they heard from me one constant refrain: "Read the notes, read the notes, read the notes." The notes to a company's financial statements often reveal critical insights behind the numbers.

The advice on how to read financial statements certainly applies to software-as-a-service (SaaS) companies, and especially to their reported customer renewal rates. SaaS companies may claim that they have renewal rates of 90% or 95%, but it's critical to look behind these numbers and understand how they're calculated.

Is a 90% renewal rate a good thing?

First, it's important to know what the company is really counting when it refers to "renewals."

Thanks to Tod Loofbourrow for his insights on this topic.

The advice on how to read financial statements certainly applies to software-as-a-service (SaaS) companies, and especially to their reported customer renewal rates. SaaS companies may claim that they have renewal rates of 90% or 95%, but it's critical to look behind these numbers and understand how they're calculated.

Is a 90% renewal rate a good thing?

First, it's important to know what the company is really counting when it refers to "renewals."

- Are they referring to the number of customers, or to revenues?

- Are they counting only the customers whose contracts are up for renewal, or all customers?

- Some companies compare the number of customers at the beginning of the period to the number of customers lost during the period. For example, if they start the year with 100 customers and lose 15 customers over the course of the year, they'd show a 15 % attrition rate or an 85% renewal rate: 15/100

- Other companies compare the number of customers at the beginning of the period plus the customers gained over that period to the number of customers lost during the period. By this alternative method of calculation, if they start the year with 100 customers, lose 15 of them over the year, but acquire 50 new customers over the year, they'd show 10 % attrition or a 90% renewal rate: 15/(100+50). Voila! An 85% renewal rate becomes 90%.

- If the subscription term is one year, a 90% renewal rate means that the company loses 10% of its customers each year.

- If the subscription term is one month, a 90% renewal rate means that the company loses 10% of its customers each month. At that rate, it will lose its entire customer base in less than one year.

Thanks to Tod Loofbourrow for his insights on this topic.

Sunday, June 14, 2009

There is No Marketing Magic Bullet

Assuming that my entire readership is more than 8 years old, I'll share this adults-only secret: There is no Santa Claus, no Tooth Fairy, and definitely no Marketing Magic Bullet.

The Marketing Magic Bullet? I'm talking about that single masterful trick, the brilliant stroke of genius, the one perfect key that unlocks the door to a roomful of success... if only we marketing folks could find it.

Stop looking. You're not going to find it because there's nothing to find.

How can I say that? I can say that on the basis of 25 years in marketing. And believe me, I've been looking. In every company, someone, somewhere is absolutely convinced that a magic bullet does exist.

"But what about Apple? One brilliant Super Bowl ad put the company on the map!"

If all it took to make a successful company was a single memorable Super Bowl ad, we'd all be buying our puppy chow and flea collars at Pets.com. Instead, their cute sock puppet is the poster child for the dot.com bust.

"If we could just get a front-page press story."

Hearing that prescription for instant success, I was tempted to suggest to that person my 100% guaranteed strategy for national press coverage: "Light your hair on fire and jump off the roof... just wait until the photographers are in place." It's probably better that I had the diplomatic good sense to restrain myself.

It's a Thousand Little Things

I once worked with Penske Racing as one of their Indy Car sponsors. (For the non-motorheads among you, Penske Racing is one of the most successful organizations in motor car racing, having just won their 15th Indianapolis 500.)

In interviewing one of the senior members of the team, I once naively asked, "Is the key to winning the car or the driver?"

He patiently explained, "It's not just the car or just the driver. It's actually a thousand little things." It's the driver, the designer, the crew, each part manufacturer, and every other element involved in putting a car on the track that can go 225 miles per hour down the straightaway and turn left at the end... for 200 laps. If all of those elements perform as required, he said, we've got a chance to win.

He didn't say anything about a "magic bullet."

The Marketing Magic Bullet? I'm talking about that single masterful trick, the brilliant stroke of genius, the one perfect key that unlocks the door to a roomful of success... if only we marketing folks could find it.

Stop looking. You're not going to find it because there's nothing to find.

How can I say that? I can say that on the basis of 25 years in marketing. And believe me, I've been looking. In every company, someone, somewhere is absolutely convinced that a magic bullet does exist.

"But what about Apple? One brilliant Super Bowl ad put the company on the map!"

If all it took to make a successful company was a single memorable Super Bowl ad, we'd all be buying our puppy chow and flea collars at Pets.com. Instead, their cute sock puppet is the poster child for the dot.com bust.

"If we could just get a front-page press story."

Hearing that prescription for instant success, I was tempted to suggest to that person my 100% guaranteed strategy for national press coverage: "Light your hair on fire and jump off the roof... just wait until the photographers are in place." It's probably better that I had the diplomatic good sense to restrain myself.

It's a Thousand Little Things

I once worked with Penske Racing as one of their Indy Car sponsors. (For the non-motorheads among you, Penske Racing is one of the most successful organizations in motor car racing, having just won their 15th Indianapolis 500.)

In interviewing one of the senior members of the team, I once naively asked, "Is the key to winning the car or the driver?"

He patiently explained, "It's not just the car or just the driver. It's actually a thousand little things." It's the driver, the designer, the crew, each part manufacturer, and every other element involved in putting a car on the track that can go 225 miles per hour down the straightaway and turn left at the end... for 200 laps. If all of those elements perform as required, he said, we've got a chance to win.

He didn't say anything about a "magic bullet."

Monday, June 8, 2009

SaaS and the Automatic Feedback Loop

One of the more useful management development courses I've taken during my career is "Practical Product Management" from Pragmatic Marketing. True to its title, it offers a practical prescription for product managers to better understand the needs of the market: Talk with one prospect, one customer, and one evaluator every month.

Product managers are instructed to use the information gathered in these discussions to become the authority within their company on what the market needs. They equip themselves to be "prospect" experts, not just "product" experts, and use their expertise to guide product development and marketing strategy.

Product managers with on-premise solutions need to consciously establish this routine of systematically gathering market input. And the best of them do it well, diligently carving out time on their calendars to meet with customers and prospects on-site, at trade shows, and user groups.

The sales and marketing for on-premise applications is essentially a straight-line process - running from "attract & cultivate qualified prospects," to "closing deals," to "deploying and supporting the application." Gathering useful input from customers and prospects requires that product managers establish an effective feedback loop themselves.

On-premise solutions follow a straight-line process, and product managers must establish a feedback mechanism themselves

SaaS Provides an Automatic Feedback Loop

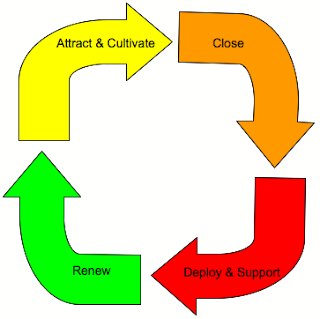

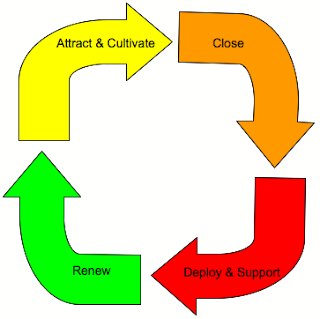

In the SaaS world, this feedback process is built right into the model. Product managers automatically get input from every single customer every single day. They can see precisely how customers are using the product, when they're using the product, and where they're running into difficulty. They have access to hundreds of useful data points from hundreds or thousands of customers.

Unlike the straight-line process of the on-premise model, under which product managers must establish the feedback mechanism themselves, the feedback loop is built right into the SaaS model. All current customers are prospects too and enhancing the solution to meet their requirements is essential to securing renewals. And SaaS companies require high renewals to succeed.

SaaS solutions provide a built-in feedback mechanism

Companies that have made the transition from on-premise to SaaS models will tell you that one of the primary advantages they've gained is their ability to better understand their customers. They use this knowledge to set smarter product development priorities and develop more effective sales and marketing strategies. (See "Taking Advantage of Customer Satisfaction Information.")

The automatic feedback loop, built into the SaaS model, gives product managers a window directly into customer and prospect behavior. They should take advantage of that window and watch what customers are doing. As Yogi Berra would explain: "You can observe a lot just by watching."

Product managers are instructed to use the information gathered in these discussions to become the authority within their company on what the market needs. They equip themselves to be "prospect" experts, not just "product" experts, and use their expertise to guide product development and marketing strategy.

Product managers with on-premise solutions need to consciously establish this routine of systematically gathering market input. And the best of them do it well, diligently carving out time on their calendars to meet with customers and prospects on-site, at trade shows, and user groups.

The sales and marketing for on-premise applications is essentially a straight-line process - running from "attract & cultivate qualified prospects," to "closing deals," to "deploying and supporting the application." Gathering useful input from customers and prospects requires that product managers establish an effective feedback loop themselves.

On-premise solutions follow a straight-line process, and product managers must establish a feedback mechanism themselves

SaaS Provides an Automatic Feedback Loop

In the SaaS world, this feedback process is built right into the model. Product managers automatically get input from every single customer every single day. They can see precisely how customers are using the product, when they're using the product, and where they're running into difficulty. They have access to hundreds of useful data points from hundreds or thousands of customers.

Unlike the straight-line process of the on-premise model, under which product managers must establish the feedback mechanism themselves, the feedback loop is built right into the SaaS model. All current customers are prospects too and enhancing the solution to meet their requirements is essential to securing renewals. And SaaS companies require high renewals to succeed.

SaaS solutions provide a built-in feedback mechanism

Companies that have made the transition from on-premise to SaaS models will tell you that one of the primary advantages they've gained is their ability to better understand their customers. They use this knowledge to set smarter product development priorities and develop more effective sales and marketing strategies. (See "Taking Advantage of Customer Satisfaction Information.")

The automatic feedback loop, built into the SaaS model, gives product managers a window directly into customer and prospect behavior. They should take advantage of that window and watch what customers are doing. As Yogi Berra would explain: "You can observe a lot just by watching."

Subscribe to:

Posts (Atom)