Now in late December, the field of my neighbor's farm is bare, except for a single row of hardy, but frozen-solid Brussels sprouts stems. In a few weeks, though, my neighbor and his crew will be working inside the greenhouse with a specially-devised planting machine. They pour a large burlap bag full of seeds into the hopper and the machine carefully inserts a single seed into an individual tray compartment. Each compartment is filled with a blend of rich soil, vermiculite and fertilizer, carefully prepared to nurture each seed into a healthy seedling.

Now in late December, the field of my neighbor's farm is bare, except for a single row of hardy, but frozen-solid Brussels sprouts stems. In a few weeks, though, my neighbor and his crew will be working inside the greenhouse with a specially-devised planting machine. They pour a large burlap bag full of seeds into the hopper and the machine carefully inserts a single seed into an individual tray compartment. Each compartment is filled with a blend of rich soil, vermiculite and fertilizer, carefully prepared to nurture each seed into a healthy seedling.In April and May, when I get around to preparing my amateur, backyard plot, I won't bother to scatter a packetful of seeds, most of which won't germinate. Instead, I'll pick up a couple of those trays, which by then will be full of healthy lettuce, tomato and pepper seedlings.

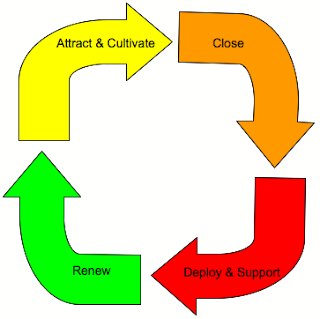

Besides giving me something to look forward to throughout the winter, there's an idea in here that can be helpful for marketers, in particular those marketing software-as-a-service (SaaS) solutions, for whom controlling the cost of customer acquisition is especially important:

Pay attention to cultivation.

It's not enough to gather a passel of leads, like 40-pound bags of seed. You need to carefully cultivate those leads and nourish them into qualified opportunities.

Here are a few ways in which these efforts often go wrong:

- Marketers are measured on "leads," not "qualified opportunities." In other words, they're rewarded for the wrong goal. This often happens because marketing doesn't own the entire process; they generate the leads, but they hand them over to sales for qualification. For this arrangement to work properly, marketing and sales need to share responsibility. That can be difficult.

- The cultivation process is starved. Money is spent on search engine optimization, pay-per-click, PR, advertising, etc., all in the interests of attracting a prospect's initial attention and gathering their name and contact information - in other words, generating a lead. (Per item 1, that's what marketing is often asked to do.) The follow-on process - cultivating that lead into a qualified opportunity -often isn't given enough resource or attention.

- The cultivation process skips a critical step. Undifferentiated leads are often handed off to sales without adequate cultivation. This is an extremely expensive way to qualify leads, particularly when the solution is sold through a direct sales force. To manage customer acquisition costs, companies need to build in a more cost-effective qualification step into the process.

- The cultivation process is too short. The leads aren't given enough time to germinate. I heard a story recently about a SaaS provider that extended their free trial period from 30 days to 60 days. The result was a substantial increase in the number of "tryers" converting to buyers. Apparently, the extra 30 days was enough time for the prospective customers to gain enough experience and confidence to actually subscribe. Reminds me of that Supremes' standard, "You Can't Hurry Love."